Nothing like a little reminder from the HR department that you're a second-class citizen:

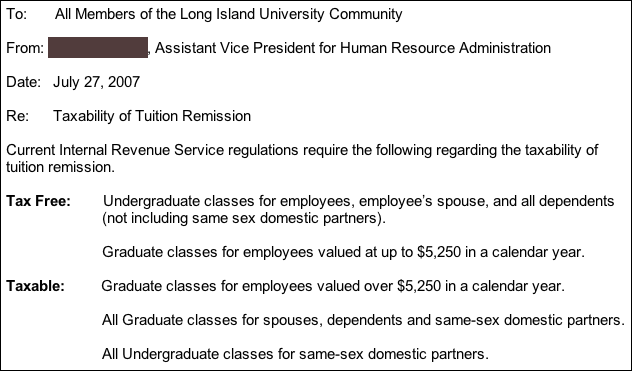

In other words, the university offers tuition remission to dependents, spouses, and same-sex partners of employees. But the IRS counts it as taxable income if you're gay. (Graduate tuition is taxable for everyone, so this difference is only for undergraduate tuition.)